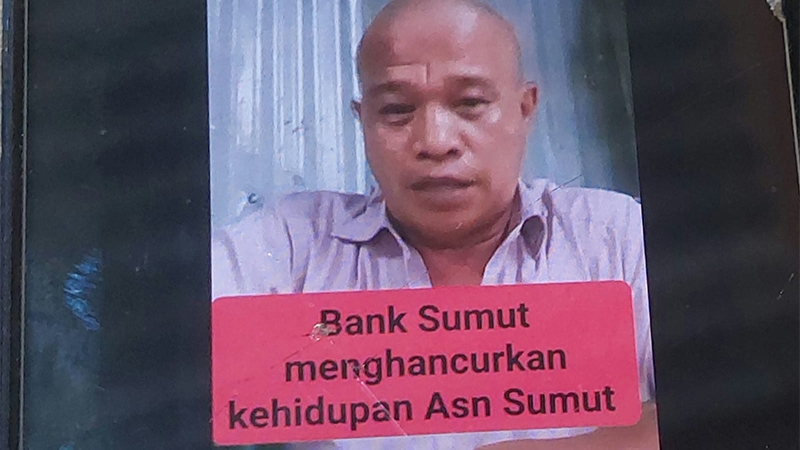

A civil servant teacher at a public junior high school in Afulu, North Nias Regency, North Sumatra, accused Bank Sumut of destroying his life. A loan from the regional government-owned bank has plunged him into bankruptcy. His salary is almost entirely absorbed by Bank Sumut, with deductions reaching 95% each month.

He poured out his complaints and frustrations on social media (his Facebook account), and the post went viral. When contacted, he confirmed that he was the person in the Facebook video post.

He recounted the beginning of the story that led to him being trapped by the loan from Bank Sumut and expressed his frustration with the bank’s service through social media.

He stated that he dared to borrow money (get a loan) from Bank Sumut because he knew of a rule that the bank must leave him with a remaining salary of Rp 750,000 each month after deductions.

However, he clarified that the Bank Sumut Lahewa Sub-Branch only left Rp 289,000 in his account per month. According to him, this deduction violated the rule.

“So I find it strange to have such a small salary remainder; how can I perform my duties?” he said.

Additionally, he found it strange that his loan application was approved by Bank Sumut with a repayment period of 16 years.

“At that time I was 43 years old; if it’s 16 years, that means I would be 59 by the time of repayment. Meanwhile, I will retire at 58, even though the maximum loan term is 15 years,” he explained.

He also revealed that he took out another loan from Bank Sumut in early 2024, with deductions coming from his teacher certification funds, which was approved by the Lahewa Sub-Branch.

According to him, after his social media post, he was contacted by Bank Sumut, who asked about his complaints. The bank also asked him to delete his Facebook post.

He then requested another loan with deductions from his teacher certification money. He called it the “Lunas Maju” system. Bank Sumut approved it, and the disbursement was received on August 2, 2025.

He also revealed that since 2025, certified teachers in North Nias are not allowed to apply for loans at Bank Sumut.

He again expressed his complaints on September 3, 2025, and the funds were disbursed by the bank.

He felt strange and wondered, if there really is a rule, why was his request continuously approved? Especially since the “Lunas Maju” loan was permitted within one month. Usually, certification loans are blocked for 6 months.

“In fact, when I requested a block, the certification was opened for one month, and the follow-up request was also opened for one week. I am puzzled; if there is a rule, why can it be opened arbitrarily?” he questioned.

The Head of Bank Sumut Lahewa Sub-Branch, when contacted, acknowledged that he is their customer and that he had seen the video post on social media.

He explained that every loan granted to a customer follows a Standard Operating Procedure (SOP). Previously, explanations were given to the customer’s family (husband/wife) by bank officers.

Even before disbursement, the marketing team usually explains details such as the credit limit, monthly installments, insurance deductions, and other information.

Regarding the rule about leaving a remaining salary of Rp 750,000 per month in the civil servant’s account after loan deductions, he emphasized that no such rule exists.

“According to our SOP for granting loans, the salary of a civil servant is deducted up to 95% of the monthly income received,” he stated.

He mentioned that he had once heard of a request from the local government that civil servants applying for loans should have Rp 750,000 left in their salary each month.

At Bank Sumut, besides salary-based loans, there are also loans where repayment is sourced from teacher certification funds; the product is called Multi-Purpose Loan (KMG) Extra.

“For functional staff like teachers, there is also a loan where deductions come from teacher certification. For this, the application is indeed limited, allowing