Hong Kong Financial Markets React Swiftly Following Fed’s First Interest Rate Cut of the Year

Following the Federal Reserve’s announcement of its first interest rate cut this year, Hong Kong’s financial markets responded quickly.

Boosted by the rate cut news, Hong Kong stocks opened higher in the morning session on September 18, with the Hang Seng Index surging at one point to break through the 27,000 mark, reaching a new high since July 2021. However, the market’s optimism did not last, as the index quickly retreated and turned negative in the afternoon session. As of the latest update, both the Hang Seng Index and the Hang Seng Tech Index recorded declines.

A securities strategist pointed out that although the Hang Seng Index broke through 27,000, it may face short-term adjustment pressure near that level. Since the start of the new upward wave in May, Hong Kong stocks are currently near the top of the rising channel, and with some technical indicators entering overbought territory after consecutive gains, it is expected that the Hang Seng Index will need to consolidate or undergo a short-term adjustment near the 27,000 level. The 10-day moving average at 26,200 is expected to provide significant support.

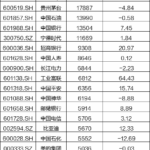

By sector, semiconductor stocks performed strongly. As of the latest update, SMIC rose by 3%, Hua Hong Semiconductor increased by 8.72%, and Solomon Systech climbed 8.16%. In contrast, the banking and insurance sectors both recorded declines.

The securities strategist analyzed that the Fed’s rate cut reduces the cost of capital flowing into the stock market on one hand, and on the other hand, helps attract foreign capital back to the Asia-Pacific markets. It was noted that this rate cut directly benefits interest rate-sensitive heavy-asset industries such as technology and real estate.

Regarding the future trend of tech stocks, the strategist remains optimistic about their upside potential. It was pointed out that the Hang Seng Tech Index has only recovered to its high from the first quarter of this year, indicating there is still room for further gains. The strong performance of tech stocks since September is primarily due to improvements in fundamentals. August earnings showed that companies like Tencent have solid growth momentum, while others like Alibaba experienced valuation repairs after market expectations had been overly pessimistic. If earnings remain robust, tech stocks are expected to continue rising.

Following the Fed’s rate cut decision, to maintain the stability of the linked exchange rate system, the Hong Kong Monetary Authority quickly followed suit on September 18, lowering the base rate through the discount window by 0.25 percentage points to 4.5%.

The Chief Executive of the Hong Kong Monetary Authority stated that Hong Kong’s monetary and financial markets continue to operate in an orderly manner. It was noted that the interaction between the Hong Kong dollar exchange rate and interest rates in recent months reflects the normal functioning of the linked exchange rate system, fully in line with the system’s design expectations. Previously, arbitrage activities driven by the interest rate differential between Hong Kong and the US led to a weakening of the Hong Kong dollar, with the exchange rate repeatedly triggering the “weak-side convertibility undertaking” from late June to mid-August. As a result, the aggregate balance of the banking system gradually adjusted, causing Hong Kong dollar interbank rates to rise from low levels, while the exchange rate returned to a more central position within the convertibility band.