ETFs continue to attract significant capital inflows. Among the 1,240 listed ETFs in the market, 421 have seen net inflows this year as of July 29. The top 10 ETFs alone have collectively drawn over 200 billion yuan in net inflows.

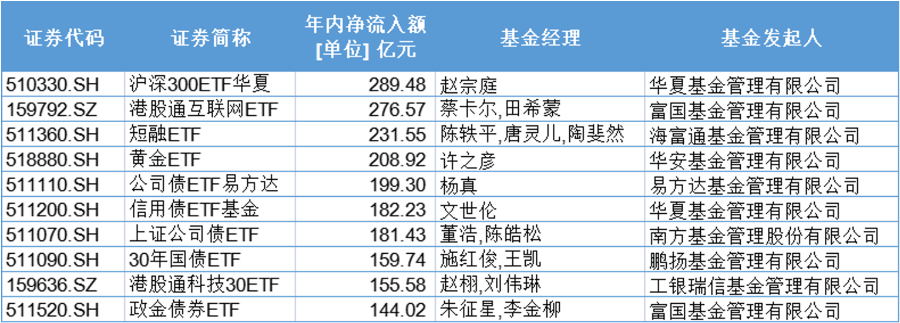

Ranking of ETFs by Net Inflows This Year

Overall, the CSI 300 ETF has been the most successful in attracting capital, with net inflows nearing 30 billion yuan this year. This reflects a generally optimistic outlook on equity assets in the first half of the year. Additionally, the Hong Kong Stock Connect Internet ETF has also seen substantial inflows. Since the beginning of the year, southbound capital has significantly increased its holdings in Hong Kong stocks, with insurance funds contributing a large portion of the incremental capital.

Beyond equity assets, several bond ETFs have also experienced notable growth. For example, the short-term bond ETF has seen net inflows of 23.155 billion yuan, benefiting from both the fund company’s expertise in bond ETFs and the economic uncertainty in the first half of the year, which drove investors toward safer assets.

CSI 300 ETF Maintains Steady Dividends, Attracts Nearly 30 Billion Yuan in Net Inflows

As shown in the chart, the CSI 300 ETF has recorded the highest net inflows this year. Against the backdrop of a bull market in A-shares, the CSI 300 Index has continued to rise, attracting investors to allocate capital through ETFs. As of July 29, the fund’s size reached 203.668 billion yuan.

Top 10 ETFs by Net Inflows This Year

While other CSI 300 ETFs have larger asset sizes, this particular fund has maintained a competitive edge through consistent dividends since 2020, typically distributed in January each year. Dividends allow the fund manager to adjust stock positions strategically, providing investors with cost-efficient redemption opportunities.

Notably, the fund did not issue dividends during the market downturn last January but proceeded with its usual dividend distribution this year after the market reached a relative high.

Hong Kong Stock Connect Internet ETF Boasts Lowest Tracking Error, Draws 27.657 Billion Yuan

This ETF has attracted 27.657 billion yuan in net inflows, ranking second overall. It tracks the CSI Hong Kong Stock Connect Internet Index and has a size of 59.272 billion yuan, significantly larger than competing products.

Top 10 ETFs by Net Inflows This Year

The index focuses on Hong Kong-listed internet companies, with the top 10 holdings accounting for over 70% of its weight. The sector has performed well this year, driven by AI-related themes. The ETF’s ability to invest via Stock Connect without consuming QDII quotas has made it particularly attractive to institutional investors.

With a year-to-date return of 34.2% and an annualized tracking error of just 2%, this ETF stands out for its performance and efficiency.

Gold ETF Leads Its Category with Over 20 Billion Yuan in Net Inflows

This gold ETF has benefited from the surge in gold prices this year, attracting over 20 billion yuan in net inflows and becoming the largest in its category.

Top 10 ETFs by Net Inflows This Year

Tracking physical gold prices, the ETF saw its holdings increase by over 4 billion units in Q2 as gold prices briefly surpassed $3,500 per ounce. Despite lower fees offered by newer competitors, this ETF remains dominant in size and institutional interest.

Gold’s role as a hedge against inflation and geopolitical risks has made it a popular choice for long-term asset allocation, with ETFs providing an accessible entry point for retail investors.</