Hot News Updates

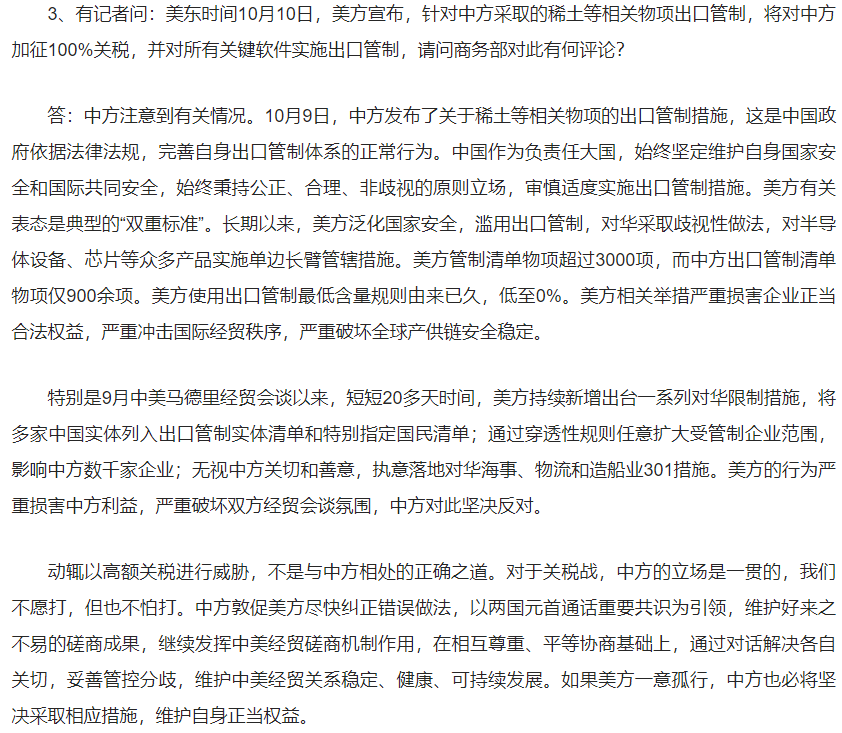

1. US Announces 100% Tariffs on Chinese Goods, Commerce Ministry Responds

2. Global Stock Markets Plunge – What to Expect Tomorrow?

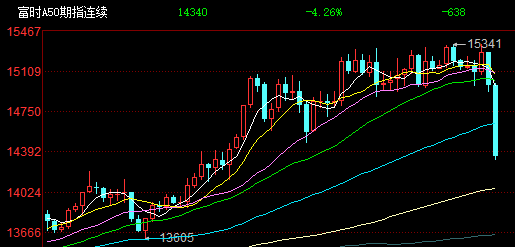

US stocks plummeted on Friday, with the S&P 500 falling 2.71% to 6,552.51 points, marking its largest single-day decline since April. The Nasdaq Composite dropped 3.56% to 22,204.43 points, also recording its biggest daily drop since April.

Chinese concept stocks, FTSE A50 futures, and Hang Seng Index futures all experienced significant declines.

Analysis:

The market is expected to open significantly lower tomorrow. How will this situation compare to the April 7th market movement?

Research institutions generally believe that the market volatility triggered by this year’s “reciprocal tariffs” won’t be a repeat of past events, so there’s no need for excessive pessimism about equity assets. From an operational perspective, investors shouldn’t rush to act when panic first appears. Instead, they can wait for market panic to slightly ease and for a rebound trend to emerge before adjusting their positions according to their needs.

Research reports indicate that A-shares may experience minor fluctuations but the upward trend remains unchanged, accompanied by market style shifts.

Analysis suggests that while the current tariff conflict may cause some short-term market disturbances, it won’t change the long-term bullish characteristics of A-shares.

Two key market indicators deserve attention:

First, mysterious capital flows. Looking back at the bottom on April 7th, substantial amounts of mysterious capital purchased ETFs, and numerous listed companies issued share buyback announcements.

Second, chip exchange. The significant decline on April 7th, driven by emotional fluctuations, led to noticeably increased trading volume, indicating rapid chip exchange.

From the perspective of pricing power, mysterious capital intervening to support the market mainly affects large-cap stocks. Quantitative funds control the pricing of micro-cap stocks, so investors should be mentally prepared if the rebound shows divergence.

3. New Kalay to Showcase Key Equipment at Bay Chip Expo

The 2025 Bay Area Semiconductor Industry Ecosystem Expo will be held from October 15-17 at the Shenzhen Convention and Exhibition Center (Futian). A press conference was held to introduce the “2025 Bay Area Semiconductor Industry Ecosystem Expo.”

It was stated that in March of this year, New Kalay made a remarkable appearance at the semiconductor equipment exhibition in Shanghai. At this Bay Chip Expo, everyone is encouraged to look forward to more surprises. New Kalay includes several subsidiaries, each of which will bring unexpected surprises to this exhibition.

Analysis:

New Kalay was established in 2021 as a state-owned semiconductor equipment and component manufacturing enterprise wholly owned by Shenzhen Major Industry Investment Group.

The core technology drawing attention to New Kalay is SAQP technology. This is an advanced micro-nano processing technology that achieves smaller chip circuit line widths under existing lithography machine precision limitations through multiple exposures and etching, representing one of the key paths to breakthrough advanced processes.

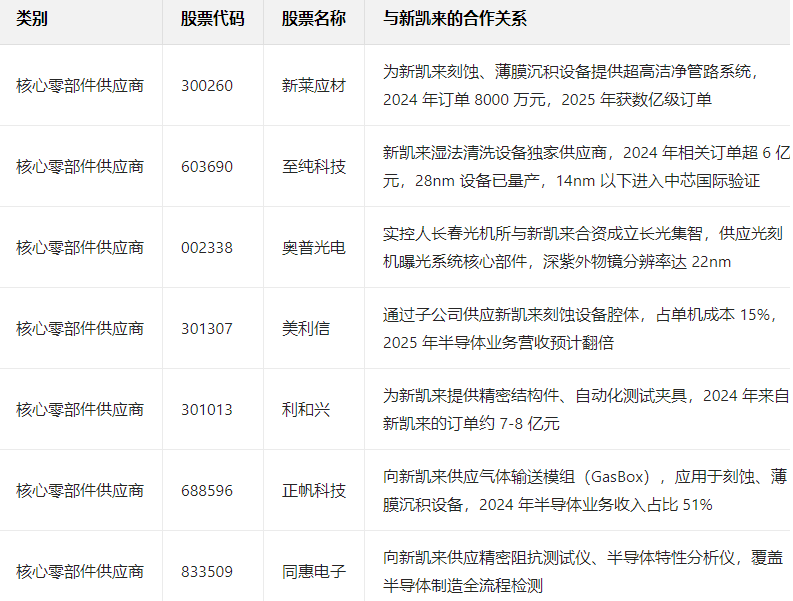

What surprises will they bring? Here’s a reference list of core component suppliers.

4. Trending Topic: Commerce Ministry Announcement Attachments Switch to WPS Format for First Time

Market Commentary

Where will the market go from here? Opinions vary over the weekend.

Optimists believe it will replicate the April 7th pattern, considering low openings as good opportunities.

Cautious investors argue that the situation is different from when it was at 3,000 points, prioritizing position control.

Multiple market perspectives maintain that the bull