Shenzhen continues to maintain its position as China’s top foreign trade city.

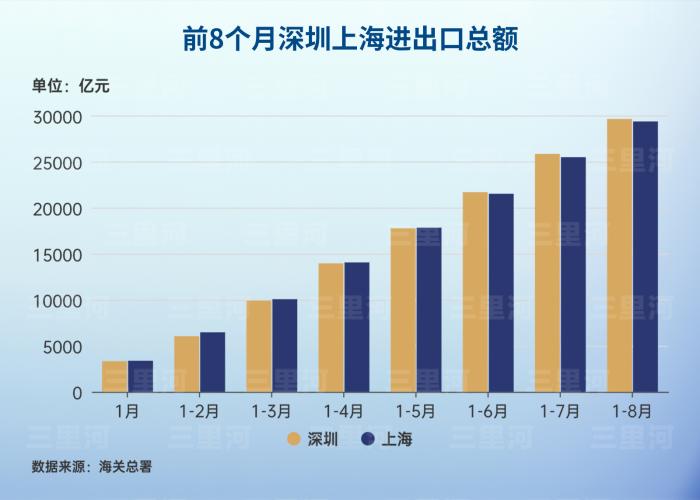

Latest customs data shows that from January to August this year, Shenzhen’s total import and export volume reached 2.96 trillion yuan, continuing to lead among major foreign trade cities in China, with an advantage of 27.181 billion yuan over Shanghai.

Against this backdrop, Shenzhen has not only maintained its scale but also demonstrated structural resilience to risks.

However, whether Shenzhen can continue to maintain its leading position remains uncertain.

From a trend perspective, Shenzhen’s foreign trade scale has been closely competing with Shanghai. Over a decade ago, Shenzhen once surpassed Shanghai to become the top foreign trade city, but was subsequently overtaken by Shanghai, maintaining that position until 2023.

In 2024, Shenzhen’s import and export scale exceeded 4 trillion yuan for the first time, reaching 4.50 trillion yuan, a year-on-year increase of 16.4%, surpassing Shanghai’s 4.27 trillion yuan during the same period, successfully claiming the title of “top foreign trade city.”

During the first five months of this year, Shenzhen’s foreign trade continued to face pressure, with total import and export volume temporarily being overtaken by Shanghai. Since June, Shenzhen has gradually recovered and resumed its leading position.

This renewed lead by Shenzhen not only consolidates its existing advantages but also signals positive developments in transformation and upgrading.

Compared to cities traditionally reliant on processing trade or single industries, Shenzhen demonstrates significant diversification and high value-added characteristics in its foreign trade structure.

Among the five key features of Shenzhen’s foreign trade summarized by customs for the first eight months, private enterprises and electronic components performed particularly well. Private enterprises accounted for nearly 70% of import and export volume, while foreign-invested enterprises showed rapid growth. Benefiting from accelerated application of artificial intelligence technology, imports of related electronic components grew rapidly. In the first eight months, Shenzhen imported 949.16 billion yuan worth of mechanical and electrical products, a year-on-year increase of 12.5%.

Unlike typical foreign trade cities, Shenzhen possesses the most complete high-tech industrial chain in China. From communication equipment and smartphones to new energy vehicles and drones, a group of globally competitive local enterprises form Shenzhen’s most solid moat in foreign trade.

These companies are not only industrial representatives of Shenzhen but also symbols of Chinese manufacturing moving up the value chain. Their competitiveness in global markets directly translates into stability for Shenzhen’s foreign trade.

In terms of data, during the first eight months, Shenzhen’s private enterprises achieved 2.06 trillion yuan in import and export volume, accounting for 69.6% of the city’s total. During the same period, foreign-invested enterprises reached 788 billion yuan in import and export volume, a year-on-year increase of 11.6%, accounting for 26.6%.

This fully demonstrates that Shenzhen’s foreign trade resilience is rooted in its unique industrial ecosystem.

Similar to Shenzhen, Shanghai also has its own advantages in foreign trade. During the first eight months, Shanghai’s import and export grew by 4.5%, with growth accelerating by 1.1 percentage points compared to the first seven months. In August alone, Shanghai’s exports of electric vehicles, lithium batteries, and photovoltaic products grew by 37.1%, 112.1%, and 39% respectively.

Looking at export products, the two cities have different areas of specialization.

Shenzhen excels in electronic information industry, with mechanical and electrical products accounting for 71% of exports in 2024, demonstrating strong global competitiveness in consumer electronics, lithium batteries, and other categories. Shanghai focuses on high-end manufacturing, with equipment products such as automobiles, ships, and integrated circuits forming its core advantages.

Notably, Shenzhen is characterized by export dominance, with exports accounting for 62% of total import and export volume in 2024, and export value maintaining the top position nationwide for 32 consecutive years.

In contrast, Shanghai plays a more prominent role as an “import hub.” In 2024, imports accounted for 57% of Shanghai’s total import and export volume, further consolidating its position as an international economic and trade hub through global procurement and distribution.</