After delivering its latest performance report, XPeng is just one step away from achieving “self-sustaining profitability.”

On August 19, XPeng Motors disclosed its second-quarter and mid-year financial reports. In the second quarter, XPeng’s total revenue reached 18.27 billion yuan, a year-on-year increase of 125.3%; net loss narrowed to 480 million yuan, with deliveries reaching 102,800 units during the same period.

In the first half of the year, XPeng’s revenue was 34.09 billion yuan, up 132.5% year-on-year; adjusted net loss was 810 million yuan, compared to an adjusted net loss of 2.63 billion yuan in the same period last year.

Thanks to adjustments in its product sales structure, XPeng’s profits continued to improve this quarter. In the second quarter, XPeng’s gross profit was 3.17 billion yuan, up 28.8% year-on-year, with a gross margin of 17.3%, reaching a record high and surpassing Tesla’s 17.2% gross margin during the same period. Xiaomi Motors also exceeded Tesla, with a gross margin of 26.4%, achieving profitability through high-volume models.

However, improving gross margin is only the first step toward true profitability—XPeng aims to cross the breakeven line in the fourth quarter of this year. The company believes its future premium will come from high-end models priced above 300,000 yuan, as well as technological and aesthetic appeal.

Compared to XPeng’s consistent emphasis on “cost reduction,” the more urgent task now is “making money.” Currently, XPeng’s R&D expenses are still climbing, reaching 2.21 billion yuan this quarter, a 50.4% year-on-year increase, hitting a record high. Sales and general administrative expenses also rose 37.7% year-on-year to 2.17 billion yuan. Combined, these two expenses already exceed XPeng’s total gross profit for the same period.

Even so, XPeng still has ample “ammunition.” As of the end of the quarter, XPeng’s cash reserves stood at 47.57 billion yuan.

The real test of execution lies ahead. According to XPeng’s forecast, its revenue in the third quarter of this year will reach between 19.6 billion and 21 billion yuan, a year-on-year increase of 94.0% to 107.9%. From January to July this year, XPeng has delivered a total of 233,900 new vehicles, completing 61.6% of its annual sales target of 380,000 units. Although the pace is tight, momentum is accelerating. Whether this growth can be translated into profitability will be the focus of the next phase.

On the first U.S. trading day after the earnings release, XPeng Motors (XPEV.N) closed up 4.3% at $20.755 per share, with a total market capitalization of $19.754 billion.

Average Vehicle Price of 164,000 Yuan, Yet Gross Margin Hits Record High

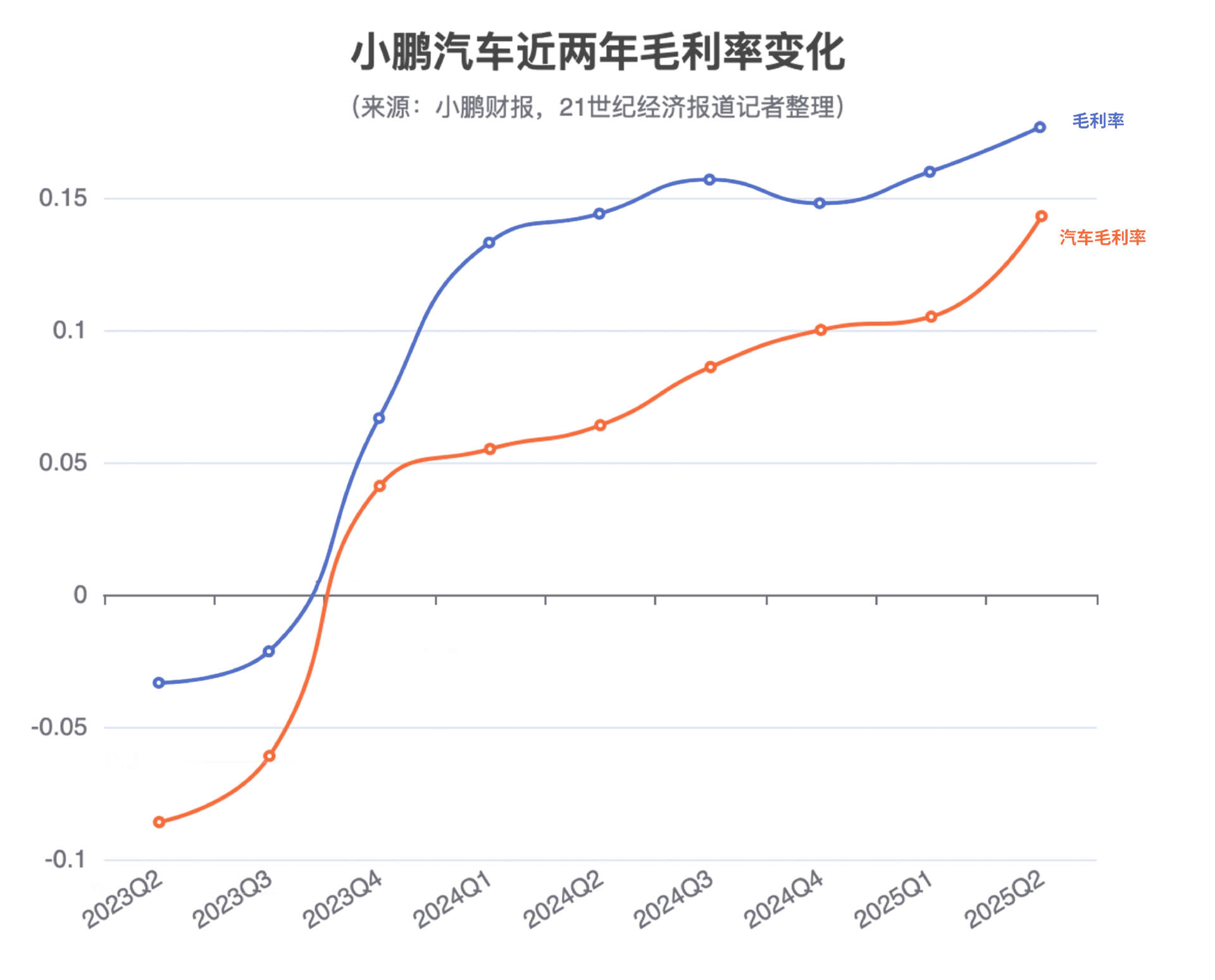

Since the launch of the XPeng Mona M03 in the third quarter of last year, XPeng’s per-vehicle revenue has declined, falling from 160,000 yuan in the fourth quarter of 2024 to 153,000 yuan in the first quarter of this year. However, gross margin has continued to rise, even surpassing that of Tesla, which has a higher average selling price. The second quarter of this year was XPeng’s highest overall gross margin quarter and also its highest vehicle gross margin quarter.

According to the financial report, XPeng’s gross margin in the second quarter reached 17.3%, up 3.3 percentage points year-on-year; the gross margin for the automotive business reached 14.3%, up 7.9 percentage points year-on-year. Total gross profit for the quarter reached 3.17 billion yuan.

Most notably, the improvement in gross margin stems from XPeng’s cooperation revenue with Volkswagen. In the second quarter of this year, XPeng’s “technology revenue” was 390 million yuan, up 7.6% year-on-year; in the first half of the year, it reached 2.83 billion yuan, up 23.3% year-on-year, accounting for 8% of total revenue. This also lifted the first-half gross margin to 16.3%.

Securing another major order from Volkswagen provides XP