“Dewu Outdoor Sports White Paper”: 60% of Users Spend Over 8,000 Yuan Annually, 96% Will Continue Spending, Showing Outdoor Industry Potential

The “2025 Dewu Outdoor Sports White Paper” analyzes development trends in China’s outdoor sports industry for 2025, providing insights into “Generation Z” consumption trends and new opportunities for outdoor sports brands.

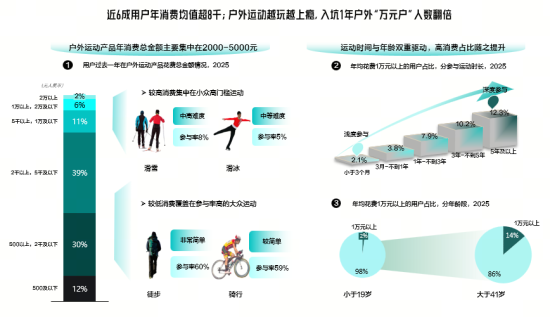

The report shows that 80% of outdoor users are “Generation Z,” who prefer the Dewu App for outdoor sports purchases and demonstrate strong purchasing power, high brand loyalty, and long consumption cycles. Nearly 60% of outdoor users spend over 8,000 yuan annually, with the number of users spending over 10,000 yuan doubling among those engaged for more than one year. Outdoor enthusiasts also show lasting purchasing power and brand loyalty, with over 30% purchasing a full set of equipment from the same brand at once; 96% of users indicate they will continue spending in the future. In terms of outdoor sports types, “Generation Z” prefers challenging activities like parkour, skateboarding, and diving, while those born in the 80s and 90s favor more relaxed activities like fishing, camping, and stream trekking.

The new consumption characteristics of “Generation Z” provide fresh growth momentum for brands. The report indicates that over 1,300 outdoor brands have quickly entered the market through new products and innovative approaches on the Dewu App, converting popularity into sustained sales and establishing classics from hit products. Since 2025, the gross merchandise volume in Dewu’s outdoor sector has increased by 100% compared to the previous year.

The report was released during the inaugural “Dewu Wildman 30 Events” activity, which aimed to invite more outdoor enthusiasts to explore nature and provide unique sports experiences.

Outdoor Sports Penetrate Urban, Wilderness, Water, and Snow Environments, with 60% of Users Spending Over 8,000 Yuan Annually

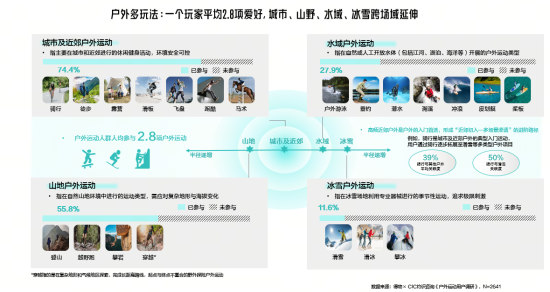

The report notes that with the hosting of major sports events like the Olympics, Winter Olympics, Asian Winter Games, and World Games, public awareness of sports has continuously strengthened, forming four main outdoor circles: urban suburbs, wilderness, water, and snow sports. As the distance from urban areas increases, sports become more advanced, and equipment budgets grow accordingly. Outdoor consumption shows a polarization: beginner players are numerous, with consumption strongly tied to travel plans, choosing sports after selecting locations; advanced players are willing to spend on specific activities, with stronger purchasing power, preferring to choose sports first and then matching locations. For example, migratory skiing enthusiasts travel long distances to destinations like Altay and the Alps for early-season skiing.

“Generation Z” is demonstrating unprecedented vitality in outdoor sports consumption, rapidly becoming the main demographic by seeking both “hardcore experiences” and “emotional value.” Nearly 60% of outdoor users spend over 8,000 yuan on equipment annually, with spending increasing over time; among users engaged for over one year, the number spending over 10,000 yuan has doubled. 96% of users plan to continue spending, with nearly 30% intending to increase their equipment investments.

Women are a significant consumer force, driving outdoor sports from “niche activities” to “mainstream lifestyles.” Beyond meeting sports needs, women are more likely to incorporate outdoor attire into daily wear, making functionality combined with style a popular trend. Salomon’s new XT-WHISPER series, “Cocoon Break Series,” and “Flowing Light Series” sold out instantly on Dewu App, attracting over 60% female users. These new products also boosted sales across the brand’s entire range, adding over 10,000 new users and increasing overall sales by more than 100% year-over-year.

Outdoor enthusiasts’ consumption diversifies over time. On average, each enthusiast engages in 2.8 outdoor activities, starting with low-barrier entries like cycling, hiking, and mountaineering. As experience grows, they explore more diverse activities, with over 50% listing hardcore sports like skiing, surfing, and rock climbing on their wish lists. “Generation Z” shows distinct activity preferences, favoring challenging sports like parkour, skateboarding, and diving, while those born in the 80s and 90s prefer more relaxed activities like fishing, camping, and stream trekking.

The Era of “Signature Products” Arrives Early, Brands Advance from New Releases to Bestsellers on Dewu App</strong