From September 10th to 14th, 2025, the China International Fair for Trade in Services was held in Beijing. As the highest-level and most influential international service trade event in the country, the fair not only showcases the latest achievements in service trade but also serves as a platform for financial institutions, technology companies, venture capital firms, and others to engage in efficient negotiations and cooperation, promoting shared development opportunities.

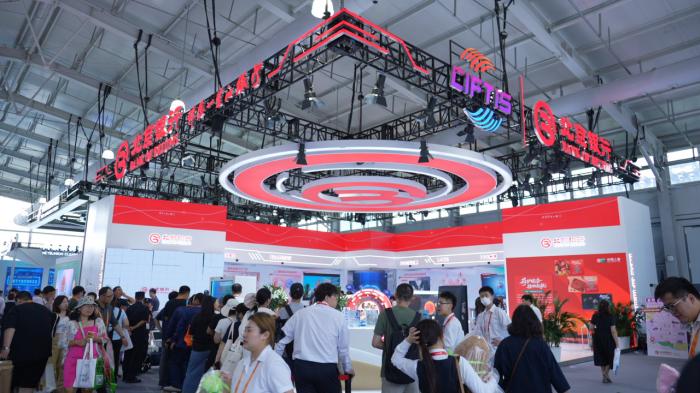

This year, as a strategic partner of the fair for five consecutive years, Bank of Beijing participated in and supported the event through innovative exhibitions, deepened cooperation and exchanges, and enriched visitor experiences, all under the theme “Digital Intelligence Leads the Way, Service Trade Renews.” This showcased a new chapter of innovative services aiding the real economy and open cooperation creating value.

Digital Intelligence Driving New Scenarios in Tech Finance

Stepping into Bank of Beijing’s booth feels like entering a tech-driven “future life exhibition.”

The first thing that catches the eye is the smart interactive digital robot “Jing Xiaobao,” which greets visitors with a wave. Equipped with powerful AI dialogue capabilities, it can quickly and accurately answer questions about financial products and services, and interact fluently in multiple foreign languages.

In front of the holographic invisible screen, vibrant colors and lifelike images exude a strong sense of technological innovation. On-site, visitors can play rock-paper-scissors with a real-time responsive mechanical hand. Within just a few minutes, a dual-arm latte art machine can create custom-designed coffee, maximizing the emotional experience.

These creative interactions not only demonstrate the warmth of banking services but also highlight how Bank of Beijing, together with ecosystem partners, integrates technological innovation into everyday consumption scenarios, bringing finance out from behind the counter and into daily life.

In the digital yuan avenue exhibition area, visitors can also experience digital yuan consumption services at the booths of cultural and creative enterprises, time-honored brands, and other partners of Bank of Beijing.

From booth design to interactive experiences, from smart product displays to digital yuan applications, every detail here is a microcosm of the service transformation of an “AI-driven commercial bank,” reflecting Bank of Beijing’s deep commitment to exploring intelligent, scenario-based, and personalized services.

Bank-Enterprise Joint Exhibition: Charting a New Path for Technological Innovation

The presence of these “cutting-edge tech” products at Bank of Beijing’s booth is no coincidence. Behind the impressive displays lies the bank’s long-standing focus on addressing the “financing difficulties” of small and medium-sized tech enterprises and its dedication to becoming the “premier bank for specialized, sophisticated, and innovative firms.”

The Tiemuniu humanoid robot, which attracted large crowds for interaction, comes from Beijing Tiemuniu Intelligent Robotics Technology Co., Ltd., a tech company with which Bank of Beijing has a deep partnership. Today, Tiemuniu has grown into a gazelle enterprise with dozens of robot patents and over a hundred copyrights, with products applied in various fields such as automotive manufacturing, 3C electronics, power, and petroleum.

As of the end of June 2025, Bank of Beijing served over 26,000 specialized, sophisticated, and innovative enterprises, with loans exceeding 121 billion yuan. It has provided credit funding of over 1.3 trillion yuan to 55,000 small and medium-sized tech enterprises, offering strong support for their growth.

From the online credit loan product “Linghang e-Loan” tailored for specialized, sophisticated, and innovative enterprises, to the “Tong e-Rong” one-stop financing