On August 11, Bitcoin surged by 3.2%, surpassing $122,000. After hitting a historic high of $120,000 on July 14, Bitcoin experienced a period of volatility before rebounding in recent trading sessions. Over the weekend, Ethereum also rose sharply, exceeding $4,300 and reaching its highest level since December 2021.

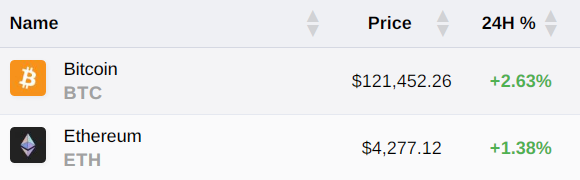

As of around 5:30 PM, Bitcoin was trading at $121,452, up 2.63%. Meanwhile, other cryptocurrencies also saw significant gains, with Ethereum rising by 1.38%.

This upward trend reflects growing interest from large investors in cryptocurrencies. According to Coingecko data, so-called “digital asset financial firms” have shifted toward investment vehicles holding substantial cryptocurrency positions, accumulating $113 billion worth of Bitcoin and approximately $13 billion in Ethereum tokens.

The rally in Bitcoin toward its all-time high is driven by continued institutional inflows into corporate treasuries, U.S. spot ETFs, and shifting market sentiment following new U.S. tariffs on imported gold bars. As gold faces supply bottlenecks and policy risks, Bitcoin is increasingly favored as a borderless, tariff-free store of value.

Experts also predict that a positive macroeconomic outlook will continue to support risk assets, including cryptocurrencies, with Bitcoin expected to break its all-time high this month.

Although Bitcoin is often called “digital gold,” its price movements have recently correlated closely with risk assets. A crypto-focused intelligence report noted that the strengthened correlation between Nasdaq and Bitcoin explains the token’s recent price action.

U.S. stocks are buoyed by optimism over the increasing likelihood of Federal Reserve rate cuts. Market attention is now turning to the July Consumer Price Index report due Tuesday, with economists forecasting annualized inflation to rise by 0.1 percentage points to 2.8%. Any weaker-than-expected reading could reinforce expectations of a Fed rate cut as early as September.

Additionally, positioning in Bitcoin and Ethereum heavily favors September and December call options, reflecting bets on macroeconomic easing and continued adoption of cryptocurrencies in traditional finance.