Gold prices rose at settlement, ending the week with weekly gains, following the speech at the annual Jackson Hole symposium, which revealed new indications for the path of monetary policy, pointing to the beginning of an interest rate cut trajectory.

Spot gold price increased by 1.1% to reach $3,373.89 per ounce, while U.S. gold futures contracts settled at $3,418.50.

The U.S. dollar also fell by 1%, making gold less expensive for holders of other currencies.

This coincided with a collective rise in the main Wall Street indices, with the S&P 500 rising by 1.2%, the Dow Jones adding 643 points, and the Nasdaq adding 1.36% to reach 21,375 points.

Federal Reserve’s Stance Adjustment

At the annual Federal Reserve meeting in Wyoming, the speech indicated that although the U.S. unemployment rate remains low, «with monetary policy remaining within a restrictive range, core expectations and changes in the risk balance may warrant an adjustment to our stance on monetary policy.»

The central bank head stated that «the balance of risks appears to be shifting» between the dual commitment to full employment and price stability. He pointed to «radical changes» in tax, trade, and immigration policies.

Markets had previously anticipated a 75% chance of a quarter-point interest rate cut in the September meeting, according to the CME FedWatch tool.

Interest Rate Cut

Traders now see an 85% probability of a 25 basis point interest rate cut in September, up from 75% before the speech, according to the CME FedWatch tool.

The remarks heavily focused on upcoming jobs and inflation data to be published before the Federal Reserve’s monetary policy meeting on September 16-17.

Gold Performance

Gold typically performs well in a low interest rate environment, as it offers no yield, making it more attractive compared to interest-bearing assets.

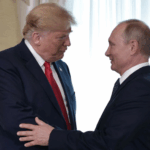

Meanwhile, the U.S. President stated on Friday that he would dismiss a Federal Reserve governor if she did not resign, intensifying efforts to gain influence over the U.S. central bank.

Physical demand for gold in major Asian hubs remained weak this week, as price volatility kept buyers on the sidelines, while jewelry manufacturers in India resumed purchases ahead of a major festival season.

Labor Market Pressures

U.S. data showed that jobless claims rose last week at the fastest pace in nearly three months, while the previous week’s claims reached their highest level in about four years, reflecting continued weakness in the August labor market.

Pressuring Geopolitical File</

Jackson Hole symposium

The Jackson Hole Economic Symposium is an annual central banking conference hosted by the Federal Reserve Bank of Kansas City, held in Jackson Hole, Wyoming. It was first convened in 1978 and has since become one of the world’s most important forums for discussing global economic issues. The symposium is particularly famous for being a platform where U.S. Federal Reserve chairs have historically signaled major shifts in monetary policy.

Wall Street

Wall Street is a major financial district in Lower Manhattan, New York City, historically known as the location of the New York Stock Exchange. Its name originates from the 17th-century wall built by Dutch settlers to protect their colony. Today, it is a global symbol of finance and American capitalism.

S&P 500

The S&P 500 is a stock market index that tracks the performance of 500 of the largest companies listed on U.S. stock exchanges. It was introduced in 1957 by the financial services company Standard & Poor’s as a tool to gauge the health of the U.S. stock market and broader economy. Today, it is one of the world’s most widely followed equity indices and a key benchmark for investors.

Dow Jones

«Dow Jones» refers to the Dow Jones Industrial Average (DJIA), a major U.S. stock market index created in 1896 by Charles Dow and Edward Jones. It tracks the performance of 30 large, publicly-owned companies and serves as a key indicator of the health of the American stock market and economy.

Nasdaq

The Nasdaq is an American stock exchange founded in 1971, notable for being the world’s first electronic stock market. It is heavily associated with major technology companies, and its headquarters features a famous digital billboard in New York City’s Times Square.

Federal Reserve

The Federal Reserve is the central banking system of the United States, established by Congress in 1913 following a series of financial panics to provide the country with a safer, more flexible, and more stable monetary and financial system. It is composed of a central governmental agency in Washington, D.C., and 12 regional Federal Reserve Banks, and its primary functions include conducting national monetary policy, supervising and regulating banks, and maintaining financial stability.

CME FedWatch tool

The CME FedWatch Tool is not a physical place or cultural site, but a financial analysis tool. It is an online resource provided by the Chicago Mercantile Exchange (CME) that uses prices from the Fed Funds futures market to calculate the probability of upcoming changes to the U.S. Federal Reserve’s interest rate. It was developed to give market participants insight into the market’s expectations for future Federal Reserve monetary policy decisions.