The confirmation of the suspension of production at Ningde Times’ Jianxiawo mine has once again fueled market sentiment to drive up lithium prices.

On August 11, Ningde Times stated on an interactive platform that mining operations at its Yichun project were suspended after the mining license expired on August 9. The company is processing the renewal application as required and will resume production as soon as approval is granted. This incident has minimal impact on overall operations.

Stimulated by this news, all lithium carbonate futures contracts—except the soon-to-be-delivered LC2508—hit their daily limit-up, driving up domestic lithium carbonate spot prices and lithium mining stocks. Ganfeng Lithium’s H-shares surged over 20% intraday.

Notably, speculative activity in lithium carbonate futures has intensified.

For instance, the turnover-to-position ratio—a measure of speculative activity—for the «old main contract» LC2509 rose from below 1x in late June to 4x by July 24. Following exchange interventions and contract rollovers, the ratio fell below 2x.

However, as some funds returned to the commodities market last week, the ratio for the «new main contract» LC2511 rebounded sharply to around 2.8x.

Increased trading activity has amplified price fluctuations in lithium carbonate futures, raising volatility risks in spot and stock markets.

Second Wave of Volatility

Since late July, lithium carbonate futures have experienced two upward trends.

The first was a roller-coaster rally from July 21 to 31, followed by a second wave starting August 1, driven by returning funds and mining disruptions.

The initial surge began with expectations of «anti-internal competition» policies and stricter mining approvals, ending when exchanges stepped in to regulate.

During this period, significant capital flowed into futures. Data from Wenhuafinance showed open interest rising from 661,000 lots on July 18 to 908,000 lots as prices approached ¥80,000/ton.

The rally was short-lived. After exchanges imposed position limits on LC2509, open interest dropped below 700,000 lots—a reduction of 200,000 lots.

However, speculation about supply constraints persisted.

Records indicate Ningde Times’ Yichun Jianxiawo mining rights began on August 9, 2022, and were set to expire on August 9, 2025.

Some investors reportedly visited the mine to verify the suspension, even waiting until 4 a.m. before leaving.

Before the news broke, half of the previously withdrawn 200,000 lots had already returned to lithium carbonate futures.

From August 6 to 8, open interest rebounded from 690,000 to 782,000 lots—a net increase of 90,000 lots.

On August 11, pre-market analyses anticipated a rally, which materialized as lithium carbonate futures opened limit-up.

By the close, all contracts except the near-month LC2508 (up 6.53%) hit limit-up, surpassing ¥80,000/ton and July 24’s peak to reach a six-month high.

Spot prices followed suit.

Wind’s average battery-grade lithium carbonate price rose ¥2,560 to ¥74,520/ton; Shanghai Steel Union’s midpoint hit ¥78,000/ton; BaiChuan’s 99.5% battery-grade lithium carbonate surged 6.99% to ¥76,500/ton.

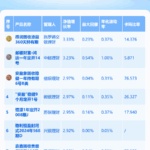

Lithium mining stocks also rallied. Shenzhen Chengxin Lithium, Jiangte Motor, and two others closed limit-up, while Ganfeng and Tianqi Lithium’s H-shares jumped 20.84% and 16.87%, respectively.

Some foreign investment banks upgraded these H-shares from «underperform» to «buy.»

Given domestic market movements, overseas lithium firms like Albemarle and SQM may also rise.

At pre-market, Lithium Americas was up nearly 9%, LAR over 9%, SQM over 7%, and Sigma Lithium over 12%.

Unlike late July, August 11 saw no major capital inflows.

Open interest edged up just 2,571 lots to 785,000, while LC2511 shed 3,030 lots to ~318,000.

This reflects market uncertainty, amplified by LC2511’s limit-up reducing liquidity.