Why China Became the World’s Lender

Since the early 2000s, China has transformed into one of the world’s leading financial powers. State-owned banks and financial institutions with substantial resources began providing loans abroad. Initially, the focus was primarily on developing countries, but over time, Chinese loans started flowing to wealthy nations as well.

According to the AidData research project, based on information from over 30,000 projects, since 2000, Chinese state-owned companies have provided loans and grants totaling more than $2.2 trillion worldwide. This figure is two to four times higher than previous estimates.

China’s overseas lending accelerated particularly rapidly after 2013, largely due to the Belt and Road Initiative. This massive international project aims to develop economic cooperation and humanitarian exchange between Central Asia, Europe, Africa, and China through the creation of new trade routes. Under this program, Beijing has allocated over one trillion dollars for building roads, ports, railways, and other infrastructure in developing countries.

Which Countries Receive Loans from China and How They Use Them

Historically, most Chinese funding has gone to developing countries (primarily in Africa and South America). For example, in Kenya, it was used for railway construction, while in Argentina, it funded hydroelectric dam projects.

Previously, most such loans were provided to governments for implementing large infrastructure projects. However, loans are increasingly taking the form of emergency support as some borrowing countries face deep debt dependency.

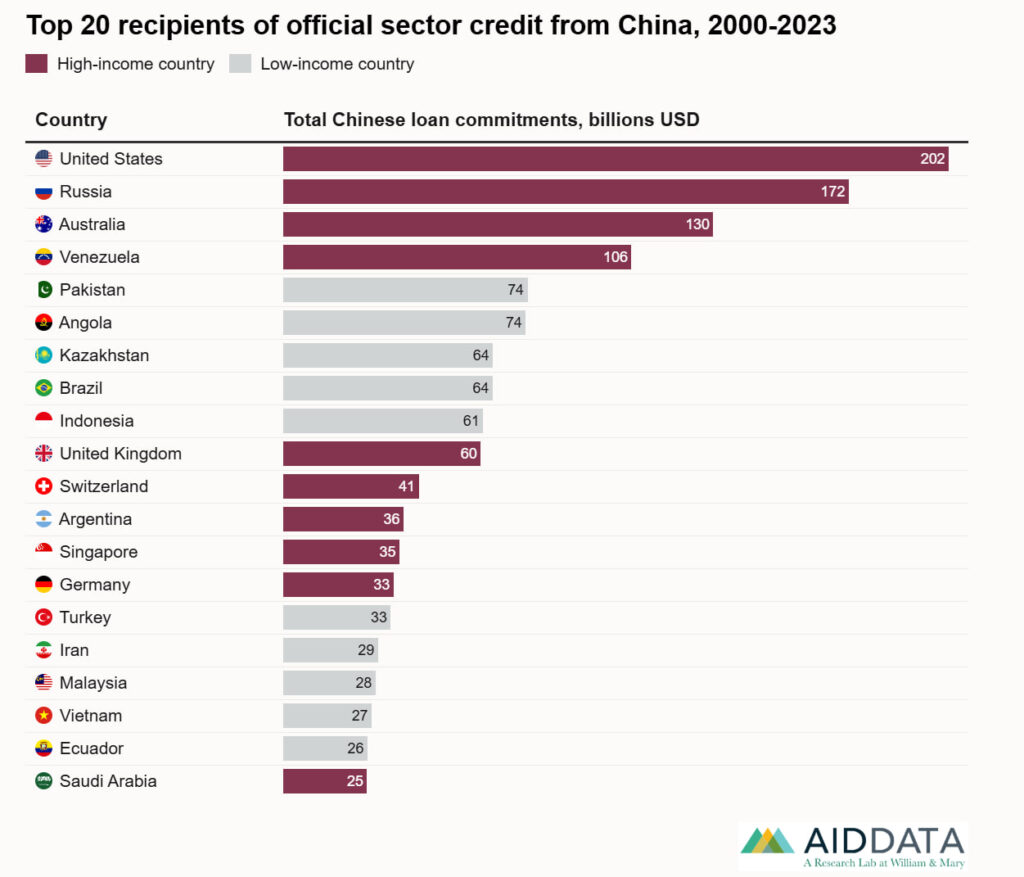

In recent years, China has reduced lending to poor countries and redirected resources to wealthy nations such as Australia and the United Kingdom. In such cases, loans are typically provided as credit lines, with lenders usually being state institutions like the Bank of China. Some of these are publicly traded and rank among the world’s largest banks, though experts categorize them as risky since they must follow political instructions from the Chinese Communist Party.

Funding goes to key sectors—rare mineral extraction, infrastructure development, and high-tech segments like chip manufacturing. According to AidData, Chinese state-owned banks have provided over $335 billion for mergers and acquisitions deals in various countries. About 75% of these funds went to Chinese companies operating in robotics, biotech, and quantum technologies.

Interestingly, the largest recipient of Chinese funds over the past two decades has been the United States. Chinese banks have provided American companies and projects with approximately $200 billion. These funds went toward pipeline construction, data centers, airport terminals, and supported corporate financing for giants like Tesla, Amazon, Disney, and Boeing.

Top 20 Recipient Countries of Chinese Loans

How Lending Benefits China

Although the initiative has been criticized for trapping poor countries in debt, the program has secured Beijing influence in regions that long remained outside Western countries’ attention. For instance, in 2021, while the US and Europe were just establishing contacts with African nations, China was investing a record $21 billion annually into their economies, funding infrastructure, agricultural modernization, and mineral extraction.

Beyond gaining new partners, loans and infrastructure construction bring China economic benefits. Africa possesses abundant cheap resources—hydrocarbons, rare earth metals, and precious stones—and is considered a major market for Chinese goods. Cheap and fast delivery requires developed transport networks and modern infrastructure, which China funds. Thus, loans simultaneously benefit African countries, where new roads, ports, and railways are built, and China, which gains stable access to resources and markets.

Additionally, by issuing loans in yuan, China reduces the US dollar’s significance in the global economy. In 2021, over