« China’s Adobe » Wanxing Technology plans to list on the Hong Kong Stock Exchange to advance its global strategy. The company specializes in digital creative software, reporting revenue of 1.44 billion yuan in 2024 with a net loss of 163 million yuan, but maintaining a gross margin of 93.22%.

Recently, Wanxing Technology (300624.SZ) announced that its board has approved a proposal to issue H-shares and list on the main board of the Hong Kong Stock Exchange.

Founded in 2003 and listed on the A-share market in 2018, Wanxing Technology focuses on digital creative software, offering video, drawing, document, and utility tools for consumers while transitioning toward SaaS, online services, content services, and cloud-based solutions.

The company stated that the H-share listing aims to further its globalization strategy and enhance its international brand and competitiveness.

Following the announcement, Wanxing Technology’s stock rose 3.88% to close at 80.11 yuan per share on August 11, with a market capitalization of approximately 15.5 billion yuan.

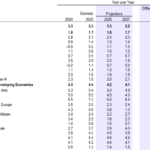

In 2024, the company’s revenue reached 1.44 billion yuan, down slightly by over 2% from 1.481 billion yuan in 2023. Quarterly data showed fluctuating performance, with Q4 revenue growing 8.1% sequentially but only 0.43% year-over-year.

However, in Q1 2025, revenue rebounded to 380 million yuan, up 6.06% year-over-year, signaling a recovery.

Video creative software remained the core business, generating 961 million yuan in 2024—nearly 70% of total revenue—with 0.06% growth, marking seven consecutive years of expansion. Key products like Filmora’s V14 update introduced multi-camera editing, AI-generated sound effects, and other innovations to sustain growth.

In contrast, utility, drawing, and document creative tools saw declining revenue, reflecting competitive pressures in non-core segments.

Profitability remained weak, with net losses in 2024 and Q1 2025. The full-year net loss attributable to shareholders was 163 million yuan, with a net margin of -10.93%, driven by higher expenses and a 59.06 million yuan goodwill impairment for subsidiary Hangzhou Gexiang. Q1 2025 narrowed the loss to 33 million yuan (-8.98% net margin).

Despite low profitability, Wanxing Technology’s 2024 gross margin stood at 93.22%, rivaling that of premium brands like Moutai.

However, margins dipped slightly due to pricing pressures and rising AI server costs. Q1 2025 gross margin was 92.26%, down 2.24 percentage points year-over-year but still elevated.

The gap between high margins and net losses stemmed from surging operating expenses.

In 2024, sales expenses rose 17.42% to 849 million yuan amid fiercer competition and higher user acquisition costs. R&D spending grew 9.9% to 442 million yuan, accounting for 30.73% of revenue, underscoring heavy investment in innovation.

Q1 2025 operating expenses hit 387 million yuan, up 75.79 million year-over-year, with sales expenses jumping 39.79% and R&D expenses rising 1.9%.

This cost surge reflects Wanxing Technology’s strategic expansion phase.

Three Competitive Moats

Despite rising costs, the company strengthened its core advantages: technological innovation, product diversification, and global reach.

In AI innovation, Wanxing Technology developed its proprietary multimedia model « Tianmu » and integrated third-party models like OpenAI and Baidu, logging over 500 million AI server calls in 2024. Products like Filmora 2025 added AI-powered lip-sync translation and advanced editing tools.

Its product portfolio spans video, drawing, document, and utility software, with Filmora’s mobile monthly active users surging 90% in 2024. AI-driven products like Virbo and SelfyzAI also showed strong revenue growth.

Globalization accelerated, with overseas revenue占比 reaching 35.1% in 2024 (3.43%-higher margins than domestic) and exceeding 90% in Q1 2025, diversifying income and funding R&D.

Opportunities and Challenges

AI monetization potential supports sustainability: AI-native app revenue doubled to 67 million yuan in 2024 (4.