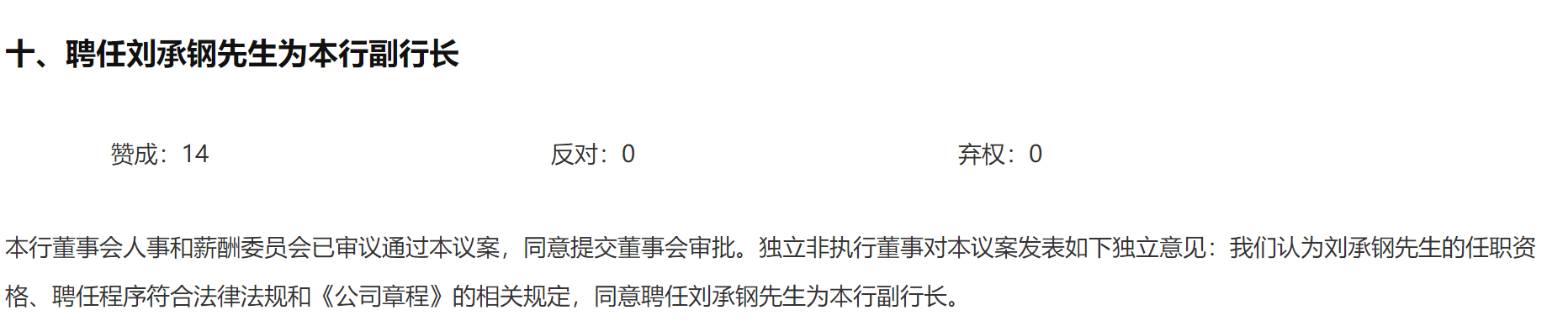

Bank of China has announced the appointment of Liu Chenggang as a vice president of the bank, pending approval from the National Financial Regulatory Administration.

Liu Chenggang was born in 1972 and joined Bank of China in 1994. He is a seasoned executive who has grown within the bank’s system and possesses extensive management experience. He has previously served as General Manager of the Equity Investment and Comprehensive Management Department, General Manager of the Financial Management Department, and General Manager of the Treasury Department at Bank of China. From April 2024 to August 2025, he served as Vice President of Bank of China (Hong Kong) Holdings Limited, and from March 2022 to August 2025, he served as Chief Financial Officer of Bank of China (Hong Kong) Holdings Limited.

Public information shows that Liu Chenggang graduated from Renmin University of China in 1994 with a bachelor’s degree in economics. In 1999, he graduated from the General Research Institute of the People’s Bank of China with a master’s degree in economics. In 2003, he graduated from Macquarie University in Australia with a master’s degree in applied finance. He also holds the title of senior accountant and is a Chartered Financial Analyst.

Once Liu Chenggang’s appointment is approved by the National Financial Regulatory Administration, the senior management team of Bank of China will consist of one president and four vice presidents, including President Zhang Hui, and Vice Presidents Yang Jun, Wu Jian, Liu Chenggang, and Cai Zhao.

On August 29, Liu Chenggang attended the bank’s 2025 interim results presentation as a member of the Bank of China Party Committee.

Recently, Bank of China released its 2025 interim report. Data shows that in the first half of 2025, the bank’s financial performance remained stable with progress, and its assets and liabilities grew steadily. From January to June, the bank achieved operating revenue of 329.003 billion yuan, a year-on-year increase of 3.76%; net profit attributable to owners of the parent company was 117.591 billion yuan, a year-on-year decrease of 0.85%.

As of the end of June, Bank of China’s total assets reached 36.79 trillion yuan, an increase of 4.93% from the end of the previous year; total loans amounted to 23.05 trillion yuan, with RMB loans from domestic institutions increasing by 1.41 trillion yuan from the end of the previous year, a growth of 7.72%. Total liabilities were 33.66 trillion yuan, an increase of 4.85% from the end of the previous year; total deposits were 25.64 trillion yuan, an increase of 1.44 trillion yuan from the end of the previous year, a growth of 5.93%.