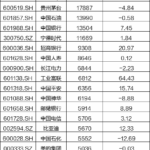

On August 6th, the Shanghai Composite Index hit a new annual closing high. At the same time, Agricultural Bank of China (601288.SH) rose 1.22% to close at 6.62 yuan per share, with a total market capitalization of 2.11 trillion yuan, reaching another historic high.

This marks the first time in Agricultural Bank of China’s history that it has topped the A-share market capitalization ranking, surpassing Industrial and Commercial Bank of China to become the new leader in A-share market value.

Besides Agricultural Bank of China, there are five other stocks with A-share market capitalizations exceeding 1 trillion yuan: Industrial and Commercial Bank of China, Kweichow Moutai, PetroChina, Bank of China, and Contemporary Amperex Technology Co. Limited (CATL).

(Disclaimer: The content is for reference only and does not constitute investment advice. Investors should proceed at their own risk.)

Shanghai Composite Index

The **Shanghai Composite Index (SSE Composite)** is a stock market index that tracks the performance of all listed stocks (A-shares and B-shares) on the Shanghai Stock Exchange (SSE). Launched in 1991, it is one of China’s most important financial indicators, reflecting the health of the country’s economy. The index has experienced significant volatility over the years, influenced by government policies, economic reforms, and global market trends.

Agricultural Bank of China

The Agricultural Bank of China (ABC), founded in 1951, is one of the country’s “Big Four” state-owned commercial banks, playing a key role in rural and agricultural financing. Initially established to support China’s agricultural sector, it has since expanded into a comprehensive financial institution with a global presence. ABC went public in 2010, listing on both the Shanghai and Hong Kong stock exchanges, marking a major milestone in its modernization.

Industrial and Commercial Bank of China

The **Industrial and Commercial Bank of China (ICBC)** is the largest bank in the world by total assets and one of China’s “Big Four” state-owned commercial banks. Established in 1984, it was originally part of the People’s Bank of China before becoming an independent entity to support the country’s economic reforms. Today, ICBC operates globally, providing financial services while playing a key role in China’s banking and economic development.

Kweichow Moutai

Kweichow Moutai (or Guizhou Moutai) is a renowned Chinese distillery famous for producing Moutai, a premium sorghum-based baijiu (liquor) with a history dating back over 2,000 years. Originating in the town of Maotai in Guizhou Province, it gained international fame after winning awards at the 1915 Panama-Pacific Exposition. Today, Moutai is a symbol of Chinese luxury and is often served at state banquets and diplomatic events.

PetroChina

PetroChina is one of the largest state-owned oil and gas companies in China, established in 1999 as part of the China National Petroleum Corporation (CNPC). It plays a crucial role in China’s energy sector, involved in exploration, refining, and distribution of petroleum products. The company reflects China’s strategic efforts to secure energy resources and support its growing economy.

Bank of China

The Bank of China (BOC), founded in 1912, is one of China’s oldest and largest state-owned commercial banks, playing a key role in the country’s financial system. Originally established to replace the Imperial Bank of China, it has expanded globally, with its iconic Hong Kong headquarters—designed by architect I.M. Pei—symbolizing modernity and economic growth. Today, BOC is a major international financial institution, supporting trade and investment between China and the world.

Contemporary Amperex Technology Co. Limited

Contemporary Amperex Technology Co. Limited (CATL) is a leading Chinese battery manufacturer and technology company, specializing in lithium-ion batteries for electric vehicles and energy storage systems. Founded in 2011 and headquartered in Ningde, Fujian, CATL has grown rapidly to become one of the world’s largest producers of EV batteries, supplying major automakers globally. The company is known for its innovation in battery technology and its role in advancing sustainable energy solutions.

A-share market

The A-share market refers to stocks of Chinese companies denominated in yuan (RMB) and traded on mainland China’s stock exchanges, primarily the Shanghai (SSE) and Shenzhen (SZSE) exchanges. Established in the early 1990s, it was initially restricted to domestic investors but has gradually opened to qualified foreign investors through programs like QFII and Stock Connect. The A-share market is a key component of China’s financial system, reflecting the country’s economic growth and evolving regulatory reforms.