Who Plans to Become a Shareholder of Intel

The administration of U.S. President Donald Trump is in talks to acquire a 10% stake in Intel Corp., according to sources familiar with the discussions. If the deal goes through, the government could become the largest shareholder of the company.

It is expected that funds from the program to support the U.S. semiconductor industry will be used to purchase the stake in Intel. Sources note that the negotiations are at an early stage and various financing options are being considered, from converting already allocated grants to attracting new funds. Earlier, under the Chips Act, Intel received approximately $10.9 billion, which corresponds to roughly 10% of the company’s market value. After reports of a possible deal, Intel’s stock rose 11% over 2 days—the best weekly performance since February.

SoftBank’s Investment

Japanese investment and technology company SoftBank has also shown interest in Intel, investing $2 billion in the American chip developer. According to LSEG, SoftBank will become the sixth-largest shareholder of the company. The new shares will be placed at a price of $23 each, giving the Japanese company a stake of just under 2%. However, SoftBank will not receive a seat on the board of directors and is not obligated to purchase Intel products.

The deal with SoftBank aims to strengthen joint investments in advanced technologies and innovations in the U.S. semiconductor industry, as noted in Intel’s press release.

These strategic investments reflect our confidence that the production and supply of advanced semiconductors in the United States will continue to expand, with Intel playing a crucial role in this.

Why the Trump Administration Needed a Stake in Intel

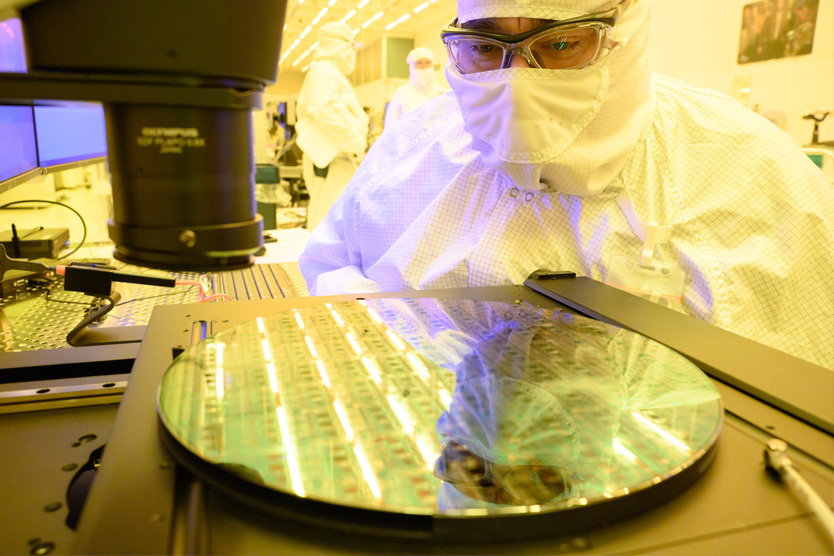

Intel is one of the leading technology companies in the United States. It produces a wide range of chips: server processors, AI chips, and high-performance computing solutions. These components are actively used in cloud infrastructures and data centers, enabling the processing of vast amounts of information. They are also essential for financial systems, space and satellite projects, and data analysis in critical sectors.

The company also plays a key role in U.S. national security, producing advanced chips for defense and intelligence systems. Losing control over their production could lead to technological dependence on China or Taiwan. This undermines the country’s leadership position in global IT infrastructure and defense technologies, especially against the backdrop of Donald Trump’s tariffs and the trade war.

Intel has already begun production of modern chips using the 18A process at its Arizona facility as part of the Eagle project. The company is also in talks with authorities about building another plant in Ohio, and potential state involvement could accelerate the creation of a major manufacturing hub in that state.

Another possible reason for investing in Intel may be the authorities’ desire to control the company’s situation. If the plans materialize, the U.S. government would become Intel’s largest shareholder, allowing it to influence the corporation’s strategic decisions. A week earlier, U.S. President Donald Trump called for the immediate resignation of Intel CEO Lip-Bu Tan, expressing concerns about his ties to China. However, after a meeting at the White House, the rhetoric softened.

How Intel Found Itself on the Brink of Crisis

In 2024, the company reported a loss of $18.8 billion—the largest since 1986. In the second quarter of 2025, the situation did not improve significantly: revenue reached $12.9 billion, virtually unchanged from the same period last year, but the operating net loss increased to $2.9 billion compared to $1.6 billion a year earlier.

The main reason for the financial decline was a 20% drop in sales of Xeon server processors compared to 2011 and more than 80% compared to 2021. Along with declining sales, Intel was forced to reduce product markups, as competitors, primarily AMD, are releasing more innovative solutions.