Global growth is projected to stabilize at 3.3% this year and 3.2% next year, with the current improvement primarily driven by China and the United States.

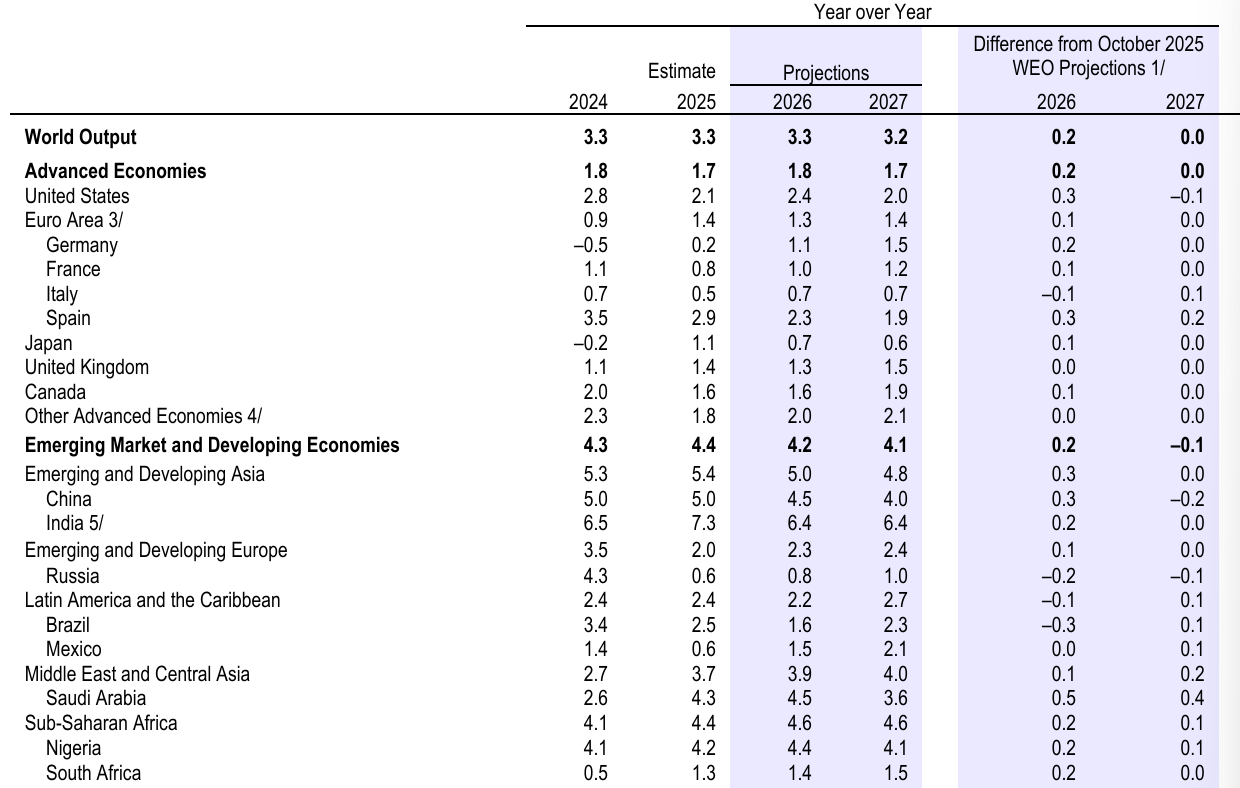

Screenshot from the World Economic Outlook report.

The headwinds from US tariff policies are being offset by the tailwinds from the wave of artificial intelligence (AI) investment, with the world economy demonstrating unexpected resilience amidst uncertainty.

In its latest World Economic Outlook, the International Monetary Fund (IMF) forecasts that global economic growth will stabilize at 3.3% this year and 3.2% next year, representing an upward revision of 0.2 percentage points for this year and no change for next year compared to the October projections. This round of improvement is mainly attributed to the two largest economies, the United States and China.

According to the latest forecasts, the US economic growth rates for this year and next are projected at 2.4% and 2.0%, respectively, which are 0.3 percentage points higher and 0.1 percentage points lower than the predictions from three months ago. For China, the figures are 4.5% and 4.0%, representing an increase of 0.3 percentage points and a decrease of 0.2 percentage points, respectively.

It was noted that this unexpectedly strong performance reflects a combination of factors, including easing trade tensions, stronger-than-expected fiscal stimulus, accommodative financial conditions, the private sector’s agile response in mitigating trade disruptions, and more robust policy frameworks in emerging markets.

Furthermore, another key driver is the continued surge in investment in the information technology sector—particularly in artificial intelligence. Although manufacturing activity remains subdued, US IT investment has climbed to its highest level since 2001, providing strong support for overall business investment and economic activity. While this growth in IT investment is concentrated in the United States, it also generates positive spillover effects globally, especially in boosting technology exports from Asia.

Prior to the IMF, the World Bank recently released a report expressing a similar view, stating that the resilience of the global economy has been “stronger than expected.” However, the World Bank pointed out that the 2020s are still on track to be the weakest decade for global growth since the 1960s, and this sluggish growth is widening global disparities in living standards: by the end of last year, per capita income in nearly all advanced economies had surpassed 2019 levels, but in about a quarter of developing economies, per capita income remained below 2019 levels.

The IMF report indicates that growth expectations for advanced economies are 1.8% and 1.7% for this year and next, respectively. Due to persistent structural constraints, growth in the Eurozone is projected at 1.3% and 1.4%, with Germany, France, Italy, and Spain at 1.1%, 1.0%, 0.7%, and 2.3%, respectively. Japan’s economic growth is expected to slow from 1.1% in 2025 to 0.7% in 2026 and 0.6% in 2027.

Growth expectations for emerging market and developing economies are 4.2% and 4.1% for this year and next, respectively. India’s growth rates for this year and next are both 6.4%, a significant decline from 7.3% in 2025. The Middle East and Central Asia region is projected to grow at 3.9% and 4.0%, while Sub-Saharan Africa is expected to grow at 4.6% for both years, both accelerating from their 2025 bases. Growth in Latin America is expected to slow slightly to 2.2% this year, with a potential rebound to 2.7% next year. Emerging European economies continue their recovery, with growth rates of 2.3% and 2.4% for this year and next.

The report shows that global trade volume growth is expected to decline from 4.1% in 2025 to 2.6% in 2026, before recovering to 3.1% in 2027. Global inflation is projected to continue declining, reaching 3.8% in 2026 and 3.4% in 2027. The pace of disinflation in the US remains slower than in most economies. Eurozone inflation is expected to fluctuate around 2%, while Indian inflation, after a significant decline in 2025, is expected to return to its target range.